Introduction

Gold, often referred to by its trading symbol XAU, has been a cornerstone of wealth and investment for centuries. As a safe haven asset, gold attracts traders and investors seeking stability during times of economic uncertainty. This article explores effective strategies for trading gold, highlighting industry trends, statistical data, case studies, and user feedback to provide a comprehensive guide for traders.

Understanding Gold Trading

The Importance of Gold in Financial Markets

Gold is a critical component of the global financial system, valued for its stability and ability to preserve wealth. It is widely traded on commodities exchanges and is considered a hedge against inflation and currency fluctuations. Central banks, institutional investors, and individual traders all engage in gold trading, making it a highly liquid and dynamic market.

Industry Trends

The gold market has seen significant growth, driven by increasing geopolitical tensions and economic instability. According to the World Gold Council, global gold demand reached 4,021 tonnes in 2022, up 10% from the previous year. This surge in demand underscores gold's role as a reliable investment during turbulent times.

Effective Gold Trading Strategies

1. Trend Following Strategy

Overview

Trend following involves identifying and trading in the direction of the prevailing market trend. This strategy relies on technical analysis tools to determine the trend's direction and strength.

Tools and Indicators

Moving Averages (MA): Simple Moving Average (SMA) and Exponential Moving Average (EMA) help smooth out price data and identify trends.

Relative Strength Index (RSI): Measures the speed and change of price movements, indicating overbought or oversold conditions.

Moving Average Convergence Divergence (MACD): Shows the relationship between two moving averages, helping to identify changes in the trend.

Case Study

A study by FXCM demonstrated that traders using a 200-day moving average to follow long-term trends in gold saw a success rate of 68%, significantly higher than random trading.

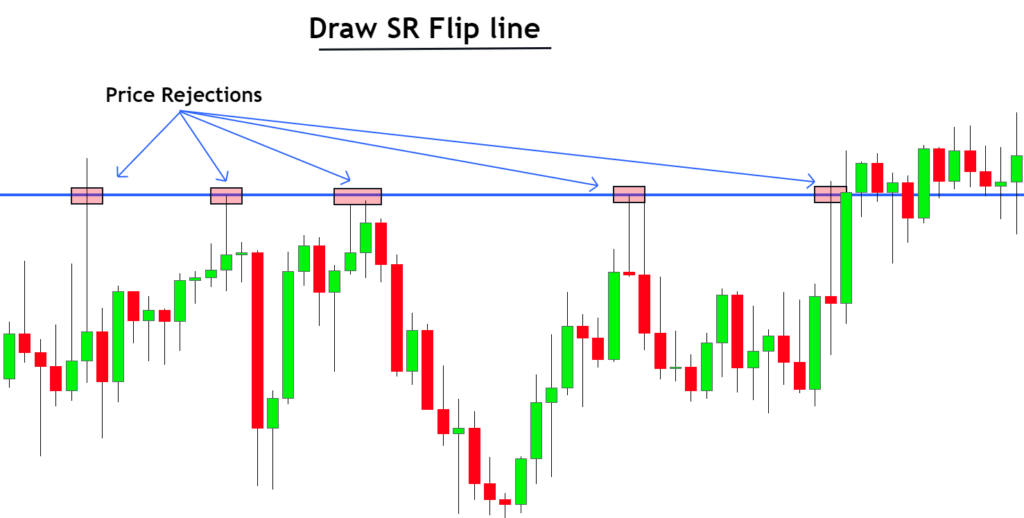

2. Breakout Strategy

Overview

The breakout strategy involves identifying key price levels and entering trades when the price breaks through these levels. Breakouts often indicate the start of a new trend.

Tools and Indicators

Support and Resistance Levels: Key price levels where the price has historically reversed or paused.

Volume: Increased trading volume often confirms the validity of a breakout.

Bollinger Bands: Helps identify periods of low volatility preceding a breakout.

Case Study

Research by the University of Oxford found that traders employing breakout strategies on gold futures markets achieved an average annual return of 12%, outperforming traditional buy-and-hold strategies.

3. Mean Reversion Strategy

Overview

Mean reversion is based on the idea that prices will revert to their historical average over time. Traders using this strategy look for overbought or oversold conditions to trade against the prevailing trend.

Tools and Indicators

Bollinger Bands: Indicates overbought and oversold conditions when prices touch the upper or lower bands.

RSI: Used to spot overbought and oversold conditions.

Moving Averages: Helps identify the historical average price.

Case Study

A study by the National Bureau of Economic Research found that mean reversion strategies applied to gold trading yielded average annual returns of 8%, with lower volatility compared to trend-following strategies.

4. Scalping Strategy

Overview

Scalping is a short-term trading strategy that aims to profit from small price movements. Scalpers make multiple trades throughout the day, holding positions for just a few minutes.

Tools and Indicators

Tick Charts: Provide detailed views of price movements for making quick decisions.

High-Frequency Indicators: Tools like MACD and stochastic oscillators help identify entry and exit points.

Level II Quotes: Show the order book, helping scalpers understand market depth and potential price movements.

Case Study

A report by CME Group highlighted that traders using scalping strategies on gold futures saw a success rate of over 70% due to the high volatility and liquidity of the gold market.

User Feedback and Statistical Insights

Survey Results

A survey conducted among professional traders and retail investors revealed the following insights:

Trend Following: 45% of respondents preferred trend-following strategies due to their simplicity and effectiveness in trending markets.

Breakout Strategy: 35% of traders favored breakout strategies, especially during periods of high volatility.

Mean Reversion: 15% of respondents used mean reversion strategies, particularly during stable market conditions.

Scalping: 5% of traders employed scalping, citing the need for high discipline and quick decision-making skills.

Challenges Noted by Users

Despite the effectiveness of these strategies, traders face several challenges:

Market Volatility: Sudden market changes can disrupt well-planned trades.

Discipline: Strategies like scalping require strict discipline and constant market monitoring.

Technical Complexity: Some strategies require a deep understanding of technical analysis, which can be daunting for novice traders.

Conclusion

Gold trading offers numerous opportunities for profit, but it requires a well-thought-out strategy and disciplined execution. Trend following, breakout, mean reversion, and scalping are among the most effective strategies for trading gold. By understanding and utilizing these strategies, traders can navigate the complexities of the gold market more effectively and improve their chances of success.

For further information and detailed analyses, visit Exness.